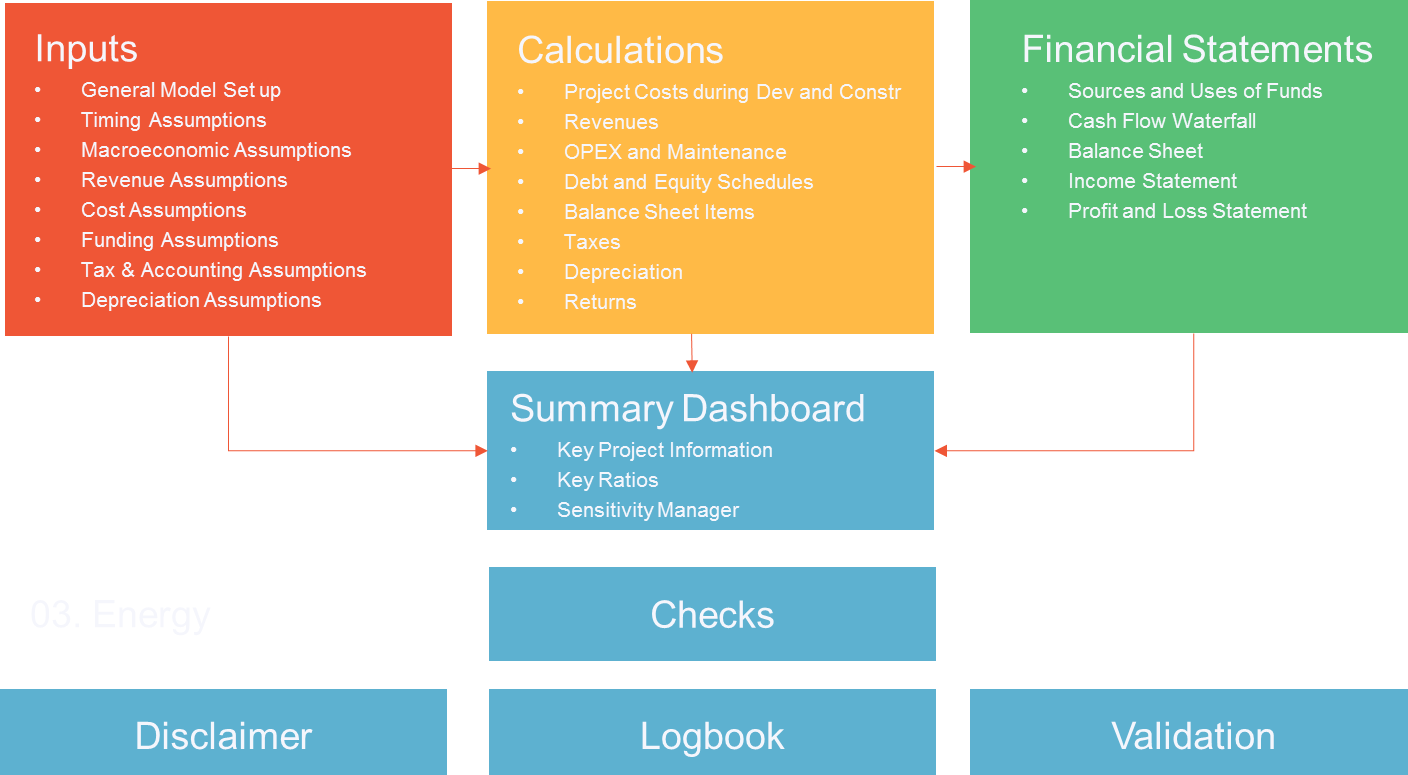

The general structure of our project finance model is illustrated in the diagram below:

One of the essential elements of our project finance model is that different calculations are made for distinct phases of the respective project – the development phase, the construction phase and the operation phase together. The sources and uses statement is computed during the development and the construction phase. Initially, the sources and uses statement replaces the balance sheet as the starting point for the calculation of balance sheet items such as the fixed assets, the debt balance, the debt service reserve balance etc. Post construction, our calculations module amongst others, will compute revenues and expenses, balance sheet items and the debt and equity schedule. Part of the debt schedule is computing the interest during construction that is capitalized to the cost of the plant (or expensed). Once the debt schedule is computed, we will further aggregate the profit and loss statement as well as the tax analysis. We will draw special attention to the modelling of the cash flow waterfall, in order to take into account the priority of cash flows to debt and equity funders as well as reserve accounts, as customary for project finance transactions. In a last step we will aggregate the project’s key data, key return figures and other statistics in a summary dashboard, together with a comprehensive set of chart analytics. Our project finance model is further equipped with dedicated check sheets to easily observe variances to the integrity of the model, together with other auxiliary sheets. Also, a dedicated scenario manager will allow for the simulation of various input variables and will present their effect on certain key ratios.