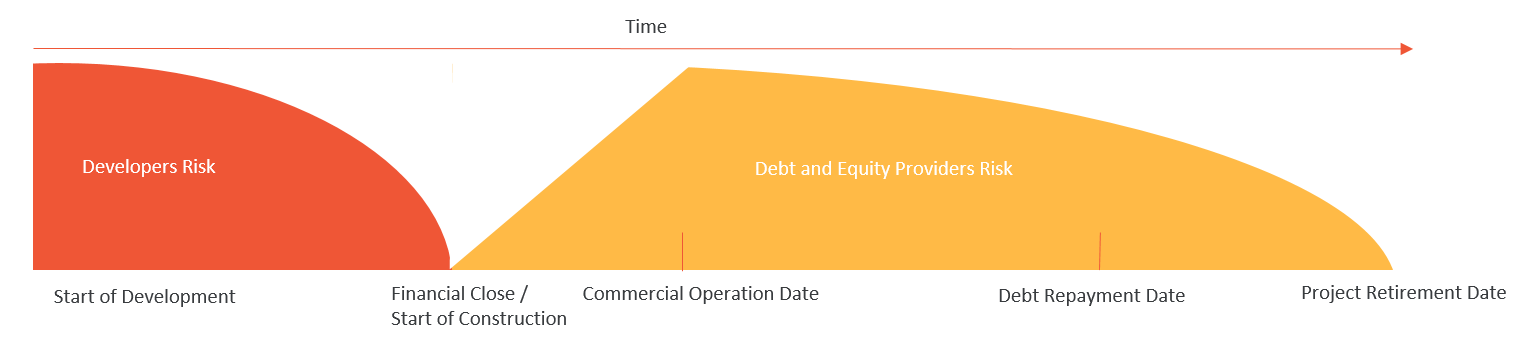

Project finance is driven by various dates that determine when various cash flows occur, e.g. cash outflows for development and construction, cash inflows from equity and debt holders, cash outflow for debt service etc. A project finance model for e.g. a renewable energy project will therefore in detail cover the following three critical phases, i.e. development, construction and operation phase and will be built around certain key dates:

- Development Phase

The period during which the project is identified, resource assessments and environmental studies are performed and key project contracts are negotiated. Financial Close marks the end of the Development Phase (development costs will typically amount to 2-5% of total project costs).

- Financial Close

The date on which all project contracts and financing documentation are signed and conditions precedent to initial drawing of debt have been satisfied or waived.

- Commercial Operation Date (COD)

The date on which the project’s cash flows become the primary method of repayment. It occurs after certain completion tests have been performed, typically involving both financial and physical performance criteria.